Sell Your Home Faster For More In

Charlotte, NC- Without the Stress

CLICK BELOW TO WATCH FIRST!

Hey, I'm Karen!

Selling a home is more than a transaction—it’s a pivotal step in your financial journey. I provide a strategic, data-driven approach that ensures your property stands out and sells for top dollar while minimizing stress.

🔹 “How can I sell quickly without sacrificing my home’s value?” → Tailored pricing strategies that attract motivated buyers

🔹 “Will I get the best possible offer?” → Negotiation expertise designed to maximize profits

🔹 “The process feels overwhelming—where do I start?” → I handle every detail, from marketing to closing, for a smooth experience

Results You Can Expect

✅ Higher Offers – My pricing strategy attracts competitive buyers

✅ Targeted Exposure – Premium listings, digital campaigns, and strategic positioning

✅ Stress-Free Selling – Comprehensive service from start to finish

Simple 3 Step Process

Step 1:

SIGN UP FOR OUR SELLING TIPS

1. Pricing Guide

2. Marketing Letter

3. Home Prep Checklist

And More....

Step 2:

GET A FREE CUSTOM HOME VALUE REPORT

Receive your report within 24 hours no commitment to sell.

Step 3:

CUSTOMIZED HOME EVALUATIONS-ONE-ON-ONE SESSION

1. Book a Complimentary Evaluation Today!

2. 🎁 Plus, Receive Our Exclusive Listing Box!

Foreclosures Are Making Headlines—But Is 2008 Back? (Spoiler: Nope.)

Foreclosures Are Making Headlines—But Is 2008 Back? (Spoiler: Nope.)

If you’ve seen the word foreclosure popping up in the news lately and felt a little déjà vu from 2008, you’re not alone. But before you start picturing another housing crash, take a deep breath—because the numbers tell a very different story.

Yes, foreclosures are ticking up, but compared to the chaos of the last housing crash, today’s market is sitting on way sturdier legs. Think of it less like a tidal wave and more like a ripple in the pool.

A Quick Reality Check

Let’s rewind. Back during the housing crash (2007–2011), more than nine million people went through some sort of distressed sale. Last year? Just over 300,000. So, even with today’s little bump, we’re nowhere near crash territory.

But what about the future? Is a big scary foreclosure wave on the horizon? Short answer: nope.

Why the Market Looks Steady

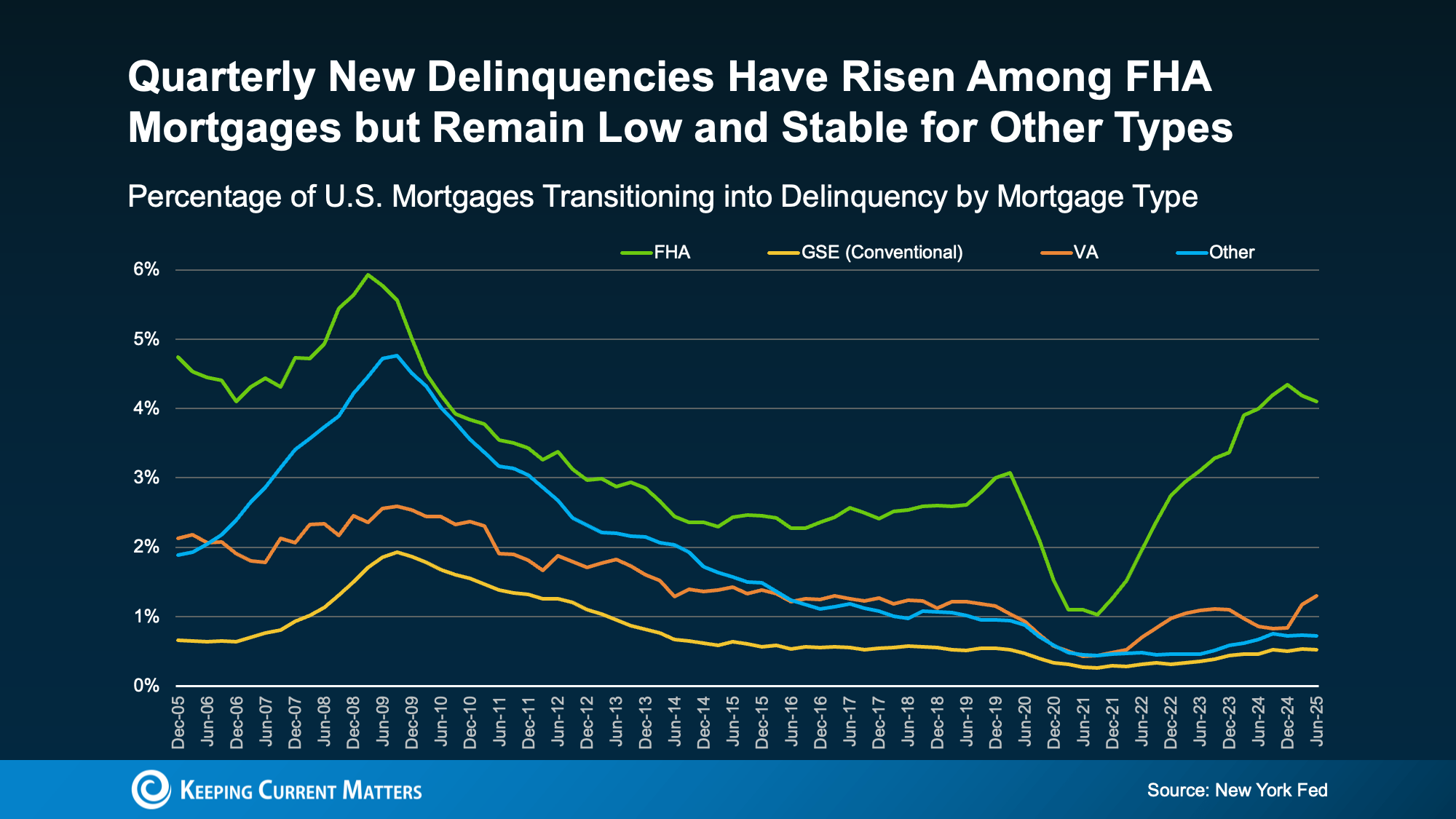

The first red flag experts look for is mortgage delinquencies (aka loans more than 30 days late). If delinquencies surge, foreclosures usually follow. Right now, though, delinquency rates are flat compared to last year—definitely not the signal of widespread trouble.

There is one wrinkle: FHA borrowers are currently making up the biggest share of new delinquencies. Why? Because FHA buyers often have smaller down payments and may feel the pinch of inflation, job changes, or economic hiccups a little faster than others.

But here’s the catch: that doesn’t mean everyone’s in trouble. Conventional, VA, and USDA loans are all holding strong with low and stable delinquency rates. Back in 2008, all loan types were elevated at once—today, that’s not the case.

Geography Matters, Too

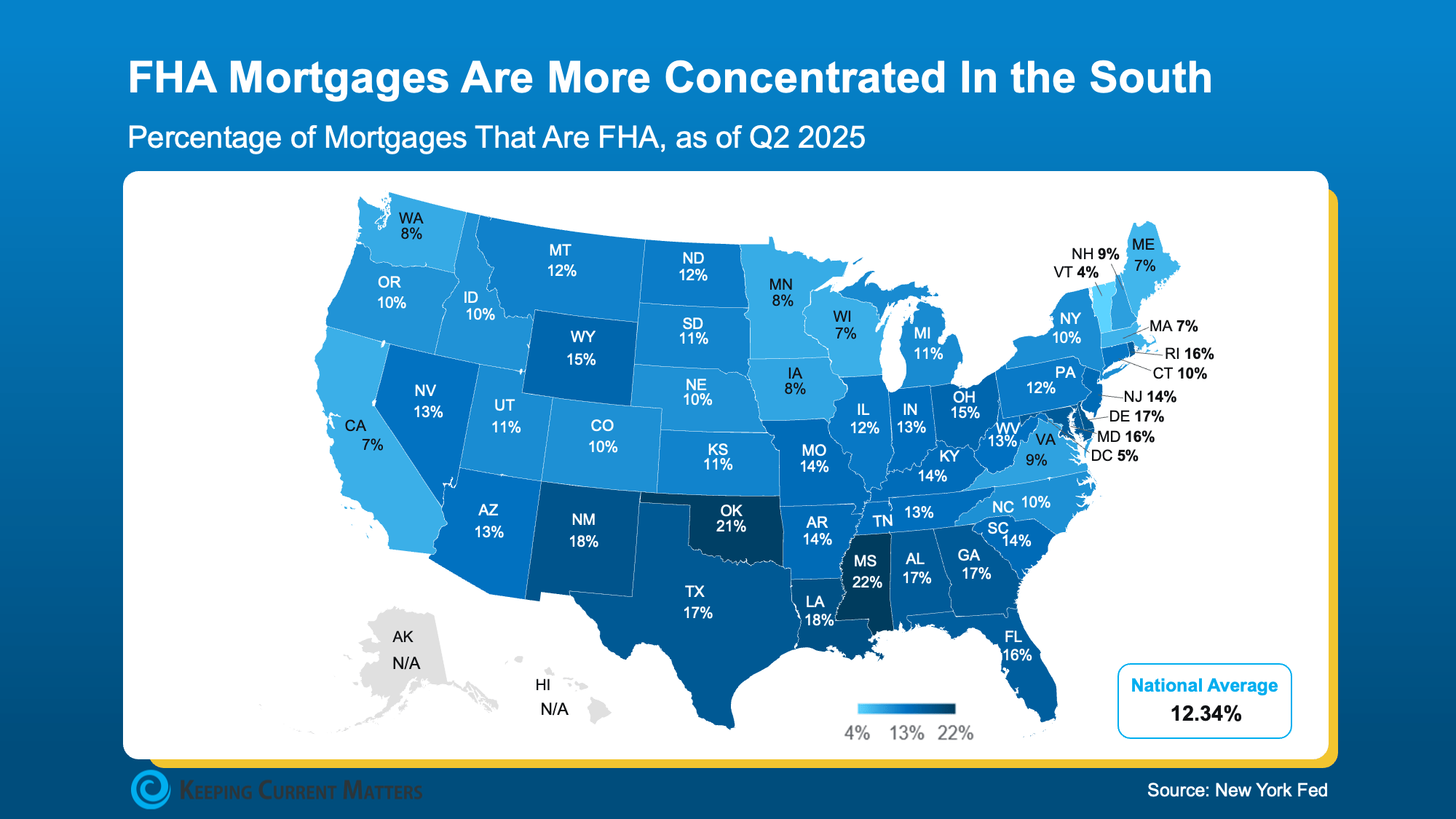

FHA loans only make up about 12% of all mortgages nationwide. That’s a pretty small slice of the pie. Still, some regions (especially in the South) rely on FHA loans more heavily, which is why those areas are seeing slightly higher delinquency numbers.

But again—don’t confuse higher concentration with higher danger. Even with those regional bumps, delinquency rates are nowhere near what we saw during the crash.

What It Means for Homeowners

Bottom line? This isn’t a crisis. Experts are keeping a close eye on the data, but overall, the housing market is much stronger than it was in 2008.

And if you are one of the homeowners feeling the squeeze, you’ve got options:

Call your lender—they may offer repayment plans or loan modifications.

Tap into your equity. Many homeowners today are sitting on record-high equity, which means you might be able to sell and avoid foreclosure altogether.

Final Word

Foreclosures may be making headlines, but the reality is far less dramatic. Rising? A little. Crash coming? Nope. The housing market isn’t sinking—it’s just adjusting.

So next time you see a scary headline, remember: it’s not 2008 all over again.

Copyrights 2025 | Karen Cynowa™ | Terms & Conditions