Sell Your Home Faster For More In

Charlotte, NC- Without the Stress

CLICK BELOW TO WATCH FIRST!

Hey, I'm Karen!

Selling a home is more than a transaction—it’s a pivotal step in your financial journey. I provide a strategic, data-driven approach that ensures your property stands out and sells for top dollar while minimizing stress.

🔹 “How can I sell quickly without sacrificing my home’s value?” → Tailored pricing strategies that attract motivated buyers

🔹 “Will I get the best possible offer?” → Negotiation expertise designed to maximize profits

🔹 “The process feels overwhelming—where do I start?” → I handle every detail, from marketing to closing, for a smooth experience

Results You Can Expect

✅ Higher Offers – My pricing strategy attracts competitive buyers

✅ Targeted Exposure – Premium listings, digital campaigns, and strategic positioning

✅ Stress-Free Selling – Comprehensive service from start to finish

Simple 3 Step Process

Step 1:

SIGN UP FOR OUR SELLING TIPS

1. Pricing Guide

2. Marketing Letter

3. Home Prep Checklist

And More....

Step 2:

GET A FREE CUSTOM HOME VALUE REPORT

Receive your report within 24 hours no commitment to sell.

Step 3:

CUSTOMIZED HOME EVALUATIONS-ONE-ON-ONE SESSION

1. Book a Complimentary Evaluation Today!

2. 🎁 Plus, Receive Our Exclusive Listing Box!

Why Charlotte Homeowners Are Finally Moving Despite Their Low Mortgage Rates

If you’re like many homeowners in Charlotte, you’ve probably thought: “I’d love to move… but I don’t want to give up my 3% mortgage rate.” That’s understandable—those low rates have been a financial win. But here’s the truth: a great rate won’t make up for a home that no longer fits your life.

Life changes—and sometimes, your home needs to change with it. And you’re not alone in making that choice.

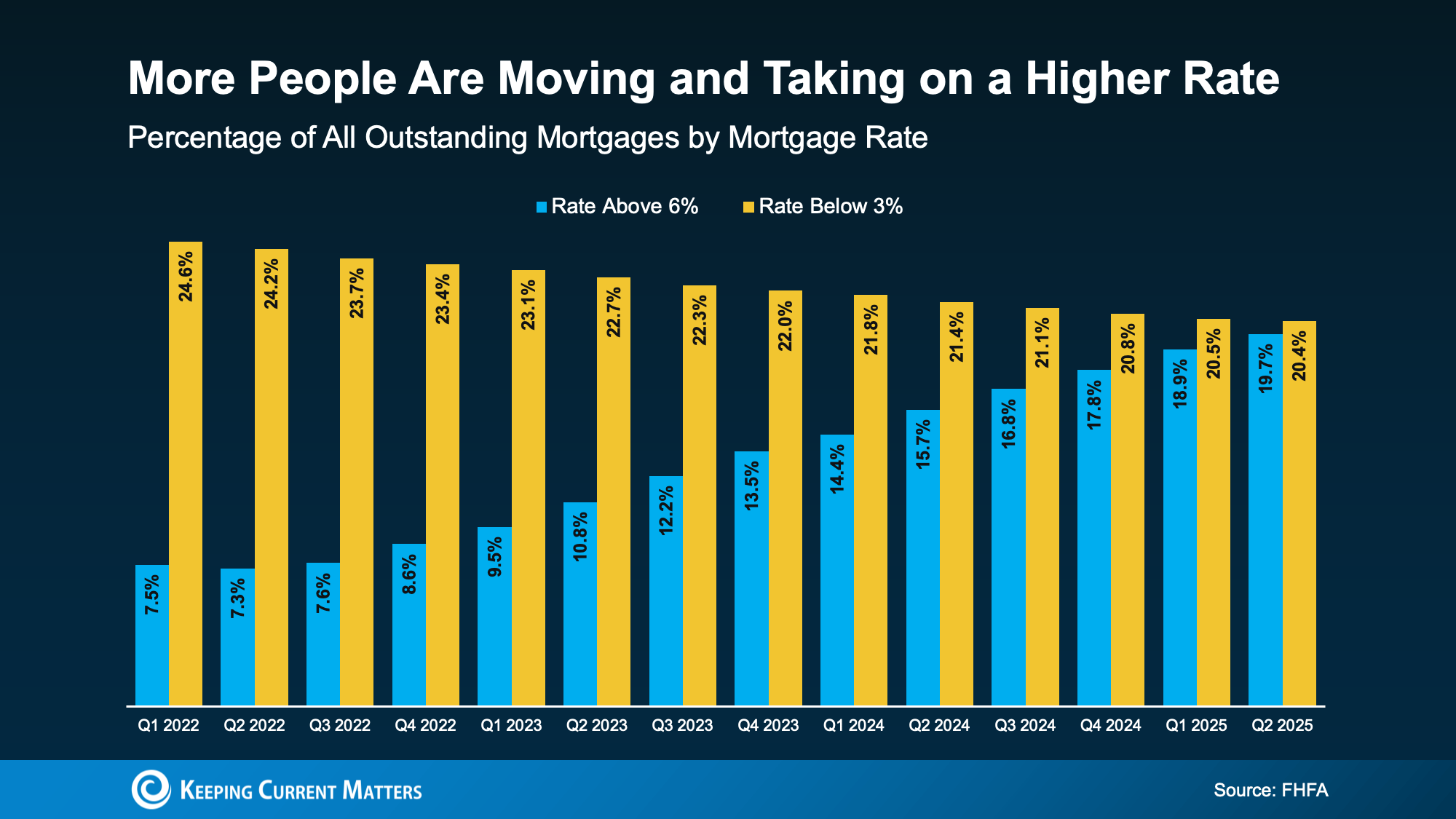

The Lock-In Effect Is Starting To Ease in Charlotte

Many homeowners nationwide, including right here in Charlotte, have been frozen in place by the “lock-in effect.” That’s when people hesitate to sell because they don’t want to take on a higher rate for their next home.

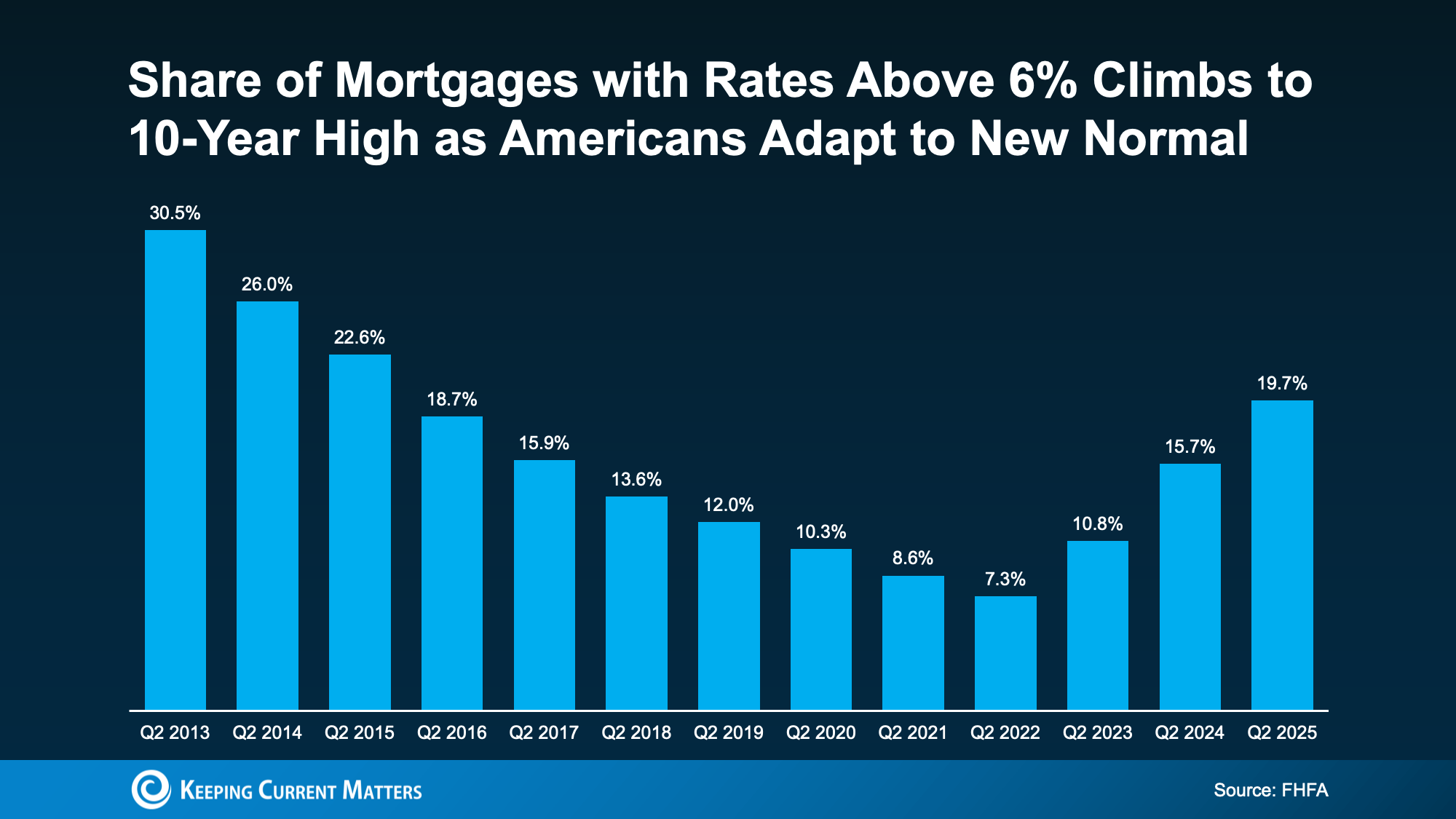

But data from the Federal Housing Finance Agency (FHFA) shows this effect is starting to ease. More homeowners are beginning to embrace today’s rates as the “new normal,” especially as Charlotte neighborhoods like Ballantyne, South End, and Dilworth continue to see strong demand.

The share of homeowners with mortgage rates below 3% is slowly declining, while those taking on rates above 6% are on the rise. This shows people are realizing that life doesn’t pause just because interest rates are higher than what they locked in years ago.

Why Charlotteans Are Moving Despite Higher Rates

It’s simple: life doesn’t wait. Families grow, jobs change, priorities shift, and a house that once fit perfectly may no longer work—no matter how good your rate is. Chen Zhao, Head of Economic Research at Redfin, explains:

"More homeowners are deciding it’s worth moving even if it means giving up a lower mortgage rate. Life doesn’t stand still—people get new jobs, grow their families, downsize after retirement, or simply want to live in a different neighborhood. Those needs are starting to outweigh the financial benefit of clinging to a rock-bottom mortgage rate."

The 5 “Ds” Driving Charlotte Homeowners to Move

According to First American, there are five common life motivators prompting moves:

Diplomas: Career growth often brings more buying power. Maybe you bought in University City years ago and now want a larger home in Matthews or Huntersville.

Diapers: Your family is growing. A new baby might mean it’s time to leave your bungalow in Plaza Midwood for a bigger home in Ballantyne.

Divorce: Life transitions can create the need for a fresh start.

Downsizing: Empty nesters in Myers Park or Dilworth may be looking for smaller homes with less upkeep.

Death: Losing a loved one often shifts priorities, such as moving closer to family in Charlotte or nearby towns like Concord or Gastonia.

Whatever the reason, the question isn’t just “Should I move?” It’s more like: “How much longer am I willing to stay somewhere that no longer fits my life?”

Why 2026 Could Be the Right Time

Mortgage rates have already eased from their peak and are expected to dip slightly more in 2026. Combine that with the very real personal reasons you may need a new home, and it might finally be the right moment to take the leap.

Charlotte’s housing market is moving, with opportunities across popular neighborhoods like SouthPark, NoDa, and Ballantyne. Whether you’re looking to upsize, downsize, or relocate for work, there are options waiting—and local agents can help you navigate them.

Bottom Line

Life doesn’t wait for the perfect rate. And neither should you. If your Charlotte home no longer fits your needs, now is a good time to explore your options, connect with a local agent, and see what’s possible in your neighborhood.

Copyrights 2025 | Karen Cynowa™ | Terms & Conditions